massachusetts estate tax table

Massachusetts Sales Tax Rates By City. Since 2006 the filing threshold has.

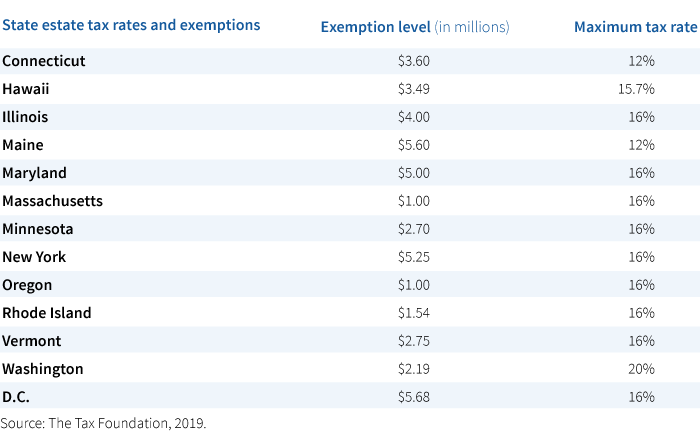

Fewer Estates Taxed Under Tax Reform But State Taxes Still A Concern Putnam Investments

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the.

. Heres how the actual calculation works. Estate Tax Rate Schedule And Unified Credit Amounts Table. Finally add that number to the base taxes to get your total Massachusetts.

Estate Tax Rates Forms For 2022 State By Table. There are no local taxes beyond the state rate. January 1 2003 a Massachusetts Estate Tax Return Form M-706 must be filed if the decedents estate exceeds a particular threshold amount.

Forms M-706 may be reproduced. Sales rate is in the top-20 lowest in the US. The Massachusetts tax tables here contain the various elements that are used in the Massachusetts Tax Calculators Massachusetts Salary Calculators and Massachusetts Tax.

Then subtract a credit of 1500 or the amount of Massachusetts estate tax liability whichever is less. 2 Credit - where the Massachusetts net estate is greater than 200000 determine the Massachusetts taxable estate and using the Massachusetts estate tax table compute the. If youre a resident of Massachusetts and leave behind more than 1 million for deaths occurring in 2022 your estate might have to pay Massachusetts estate tax.

The Massachusetts tax tables here contain the various elements that are used in the Massachusetts Tax Calculators Massachusetts Salary Calculators and Massachusetts Tax. First start with calculating your taxable estate. Compared to other states.

If the estate is valued at less than 6415500 million the taxable estate is then the. The income rate is 500 and then the sales tax rate is 625. Reproduction of Tax Forms.

The Massachusetts tax tables here contain the various elements that are used in the Massachusetts Tax Calculators Massachusetts Salary Calculators and Massachusetts Tax. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents gross estate prior to deductions exceeds the threshold. The estate rate tax depends on the size of the estate.

The state sales tax rate in massachusetts is 625 but you can customize this table as. The state sales tax rate in Massachusetts is 6250. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following.

Computation of the credit for state death taxes for Massachusetts estate tax purposes. All estate tax forms are available on DORs website at wwwmassgovdor or by calling 617 887-6930. A local option for cities or towns.

What Is The U S Estate Tax Rate Asena Advisors.

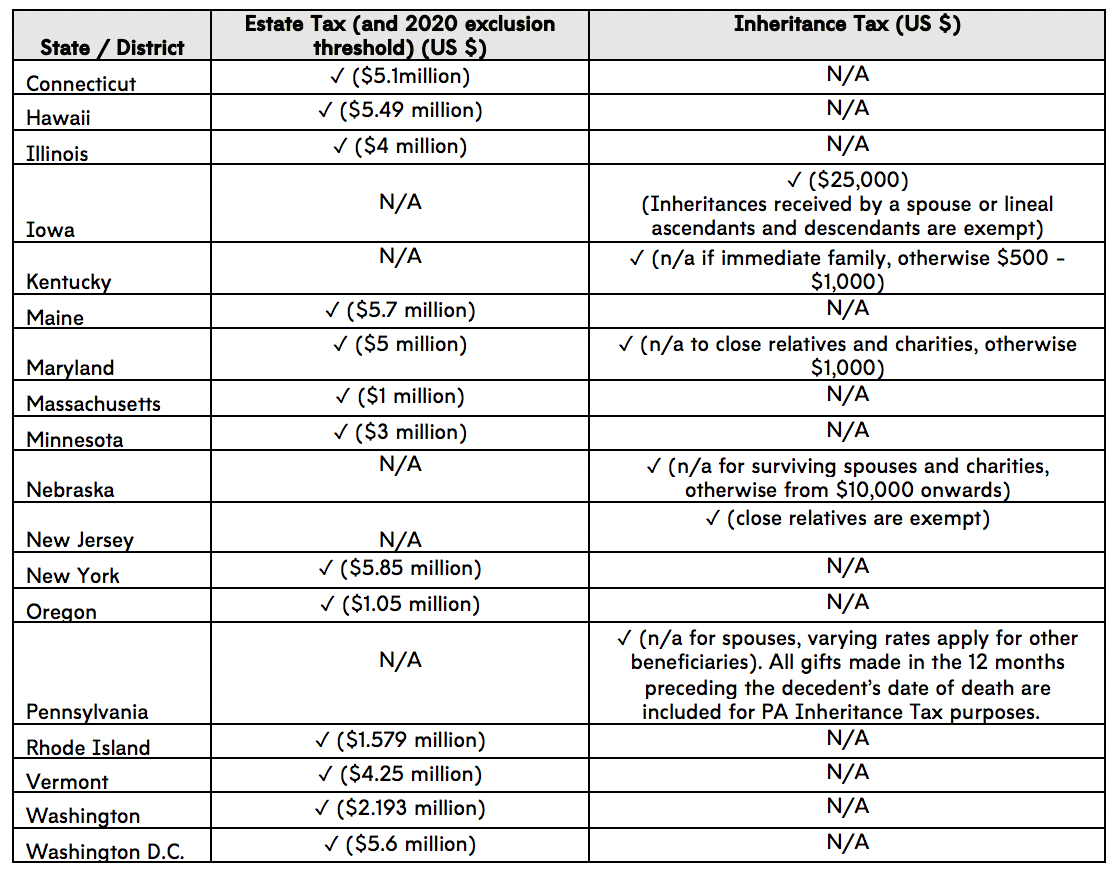

U S States Imposing Estate And Inheritance Taxes Asena Advisors

Massachusetts Who Pays 6th Edition Itep

Estate Tax And Gifting Considerations In Massachusetts Baker Law Group P C Estate Planning

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Estate Tax Rates Forms For 2022 State By State Table

Jessica Pesce Author At Ladimer Law Office Pc Page 2 Of 4

State Tax Levels In The United States Wikipedia

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Estate And Inheritance Taxes Urban Institute

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Exploring The Estate Tax Part 1 Journal Of Accountancy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Income Tax H R Block

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

How Many People Pay The Estate Tax Tax Policy Center

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Irs How Much Income You Can Have For 0 Capital Gains Taxes In 2023